Unmanned Airspace’s bi-annual review of the UTM market, The market for UAV Traffic Management Services – 2024-2028, September 2024 edition concludes the market for UTM systems and services will be worth USD1.8 billion between 2024 and 2028, and identifies eight revenue streams for UTM infrastructure and service providers.

But the most of important market for UTM companies remains in a holding pattern.

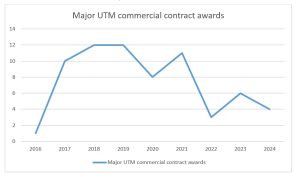

“The number of large scale commercial UTM eco-system development contracts has not risen exponentially, as expected but, instead, peaked during 2018 and 2019,” said Philip Butterworth-Hayes, the report author.

There are still no fully-certified UTM/U-space infrastructure managers and service providers managing complex drone operations (beyond visual line of sight, flights over people, nighttime flights and one-operator-to-multiple-drones) underpinned by agreed regulations and standards. Instead, there are several localised UTM operations – in Dallas (USA), in Tel Aviv (Israel) and the North Sea ports of Europe and at some airports – where UTM operations are in now place managing operational drone traffic in a pre-commercial phase. These operations include both highly centralised (North Sea ports and Tel Aviv) and highly decentralised (Dallas) UTM architectures.

“We continue to forecast a difficult 2025 for UTM service providers as central government funding for research starts to tail off but commercial revenue from UTM services for more complex drone flights and the first eVTOL operations have yet to fully take off. Further consolidation in the UTM sector looks inevitable,” said Butterworth-Hayes.

Even though the initial stages of the commercialisation of the global UTM market is not expected before 2025 the eight current and potential revenue streams for UTM infrastructure and service providers, still provide some flexibility for UTM companies to generate income in the short term. These revenue streams comprise:

- Developing a national UTM programme in a commercial contract with a regulator/ANSP

- National government and inter-governmental funded research

- Prototype UTM service within a defined drone eco-system (eg a port or airport)

- Income from operational UTM infrastructure provision

- Income from operational UTM service provision

- UTM-as-a-service for drone and eVTOL operators/OEMs

- UTM partnership in vertiport-focused AAM eco-system

- Consultancy and other revenue streams – from defence contracts, private landowners, airports etc.

“It is not all bad news,” said Butterworth-Hayes. “In Europe, momentum is building towards operational deployment. Some of the large-scale U-space integration trials will become a basis for real-world operations. And, most important of all, certification of U-space service providers (USSPs) is just around the corner. In September 2024 the Direction Générale de L’Aviation Civile reported that it is close to certifying potentially the first USSP in Europe. We expect to see a gradual roll-out of national UTM systems start in 2025, as the regulatory requirements for service provision become clearer. Initially, governments and local ecosystem developers (such as ports, airports and cities) will be required to find initial infrastructure investment before the commercial cases evolve for service providers, supplementary data providers and mobile network operators.”

“Over the last few months, United Arab Emirates (UAE) States have announced major advanced air mobility (AAM) eco-system development plans, with eVTOLs starting widespread commercial services there as early as 2025,” said Butterworth-Hayes. “These programmes present some of the toughest challenges facing airspace planners in the world today. In Dubai, for example, passenger carrying eVTOLs, large cargo freight drones and personal flying vehicles will soon be sharing the same airspace. In Abu Dhabi, autonomous eVTOLs – with integrated UTM systems – will also be sharing airspace with piloted eVTOLs using independent UTM systems. At least three vertiport companies are also developing infrastructure in the emirate, some with approach/departure UTM services integrated into their design and others without.

“But one has to ask, if regulators, research organisations, standards bodies and industry have struggled over seven years to develop UTM systems certified to manage multiple BVLOS drone operations (and we are not there yet), how long will take it them to certify the far more complex UTM systems needed to manage autonomous eVTOL operations? Even a first generation AAM UTM system is complex, with vertiport departure and arrival procedures integrated within an ATM system, which features demand-and-capacity-balancing within alongside tactical safe separation management. If regulators are unable to keep up with rapidly evolving industry advances the onus will be on standards organisations to develop industry-agreed standards for the exchange of safety related and optimal usage airspace data – a radical change to the global aviation regulatory system.”

The world’s most detailed UTM market analysis and forecast reportThe latest 433-page edition of The market for UAV Traffic Management Services – 2024-2028, gives the world’s most comprehensive, accurate and validated guide to market forecasts, opportunities and future developments within the global UTM market. Our latest September 2024 edition of the report includes: · Country-by-country analysis of UTM developments – what has been achieved and what it being planned · Detailed focus on UTM infrastructure and services revenue potential and business case opportunities · Analysis on UTM developments within the advanced air mobility sector · Forecast revenue for eight core UTM services · Analysis of expected demand for BVLOS drone missions – a key driver to the UTM sector · Analysis of high level forecasts for the drone and AAM/UAM industries We provide an analysis of UTM financing trends and the UTM market for urban and port-based air mobility systems. We have gathered information first-hand from government and industry sources around the world to gain a country-by-country perspective on how UTM services are being developed and introduced. We look at how charging for UTM services is being planned and how UTM service providers, including air navigation service providers (ANSPs), are aligning their business plans to the changing market requirements. We report on the key technology drivers that are shaping the market and report on the companies that are winning the major contracts and how their technology and business plans are aligned to the market. We look at potential revenue streams for UTM service companies and provide an analysis the priorities of governments, air navigation service providers and cities in the search for industry partners. To download a sample of the report, please click here. For more information on the report, please contact the editor at Philip@unmannedairspace.info The forecast is available for €888/US$981/£750 for a pdf copy of the report sent by email. To order the report, please send your request to: marketforecast@unmannedairspace.info and we will send you an invoice either via paypal for payment by credit/debit card settlement or a pdf invoice for bank transfer payment |

(Image: Shutterstock)