The following excepts are taken from the forecast report.

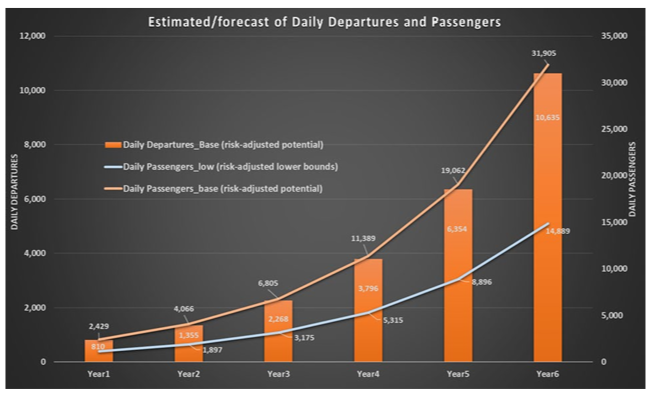

“Assuming EIS successful, AAM departures will then likely accelerate and reach almost 3.9 million a year in a very short time (i.e., by the end of Year 6), provided outstanding integration issues involving new entrants have been appropriately addressed and resolved,” say the latest FAA forecasts. “In the lower-case scenario estimate, the likely departures are expected to be around 207,000 to a level of 553,000 cumulatively by Year 2. It may likely reach around 2.7 million by end of the projection in Year 6.

“Although there are several aircraft under development for the AAM/UAM market, we assume relatively low load factors (e.g., 2-3 passengers per departures for lower and base cases, respectively).

“Starting from an anticipated 887,000 passengers annually, a cumulative 2.3 million passengers may be reached soon after EIS by Year 2 in the base-case scenario or risk-adjusted potential scenario.

“Generally speaking, eVTOLs are assumed to have, for majority of vehicles that have been presently designed (over 200), one to four passengers with one pilot on board. On average, trips are expected to have a passenger load of three riders for airport shuttle, as reported by market studies accounting for the shared route model of Air Metro The base case reported in the table (i.e., 3 passengers) draws on this recent finding. However, air taxi is expected to have much lower passenger load (1 passenger) due to on-demand nature of services and associated mobility flexibility in the base-case scenario, we calculate a few hundred departures transporting a few hundreds to around 2,400 passengers daily to begin with in Year 1. Around 2,100 cumulative daily departures transporting around 3,000-6,500 cumulative passengers (i.e., lower to base cases, respectively) may be attained soon after by Year 2. It may reach a level of over 10,000 daily departures in base case transporting around 15,000 daily passengers in lower range scenario to around 32,000 in base case scenario in Year 6.

“One of the major challenges of eVTOL entering the AAM marketplace is infrastructure. In a recently published report, GAO (2022) estimates that for smaller metropolitan areas (1.5-2.5 million population), 6 vertiports will be needed while for larger metro areas (7-10 million population), the numbers may go up as high as 77.

“Total estimated ground cost for smaller metro areas have been estimated to be USD50 million while for larger metros, it is almost 5-times higher at USD240 million. ASSURE (2022) reported that an estimated 75-300 vertiports will be required for each metro area. In total, ASSURE estimates 2,500-3,500 vertiports will be needed to establish a mature AAM passenger network nationwide in the US.

“FAA-sponsored research estimated revenues from AAM/UAM operations to be modest; at around USD150 million in around 2025/2026 that is likely to reach around USD2.7 billion in 2030. Combining these revenue projections with departure and passenger forecasts reported above, average fare per passengers is calculated to be around USD80-USD120 corresponding to base and lower-range cases, respectively. Recent service announcement implies price (i.e., around USD136-USD200 for a full cabin of four passengers or USD34-USD50 per person] to be around half that ASSURE-implied prices calculated from revenue estimates.

“AAM services are likely to face stiff competition from technological advances in industries with close substitutes, such as ground transportation (i.e., emerging automated solutions on increasingly electric-powered vehicles). Furthermore, economic and financial tradeoffs underlying the emergence of AAM.”

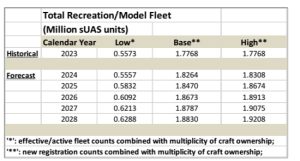

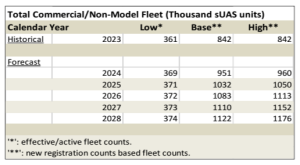

For the drone market, recreational drone sales will peak in the next five years, while the commercial drone fleet will reach 1.12 million units by 2028.

“The FAA forecasts that the recreational small drone fleet will likely (i.e., base scenario) attain its peak over the next 5 years, from the present 1.78 million units to approximately 1.88 million units by 2028, thus attaining cumulative annual growth rate of 1.2% during 2023-2028. Based on registration data, the size of the commercial drone fleet (> 0.5 lbs. and up to 55 lbs.) totaled approximately 842,000 aircraft by the end of 2023. As the base (i.e., the cumulative total) increases, the FAA anticipates the growth rate of the sector to slow over time, and forecasts the commercial drone fleet to (i.e., base scenario) be about 1.12 million by 2028.”

Given trends in recreational UAS registration and market developments, the FAA forecasts that the recreational small UAS market, which includes all UAS with weights greater than 0.55lbs and less than 55lbs operated for enjoyment, will saturate at around 1.88 million units over the next five years. However, there is still some upside uncertainty due to further changes in technology, including battery life, faster integration from a regulatory standpoint, and the likely event of continued decreasing prices. This leads to upside possibilities in the forecast of as many as 1.92 million units by 2028.

“Last year, the FAA forecasted that the commercial UAS sector, which includes all UAS with weights greater than 0.55lbs and less than 55lbs operated for non-recreational purposes, would include over 805,000 small UAS in 2023 for the base case, a growth rate exceeding 11% over the previous year (2022). Actual data came in over 842,000 aircraft by the end of 2023. Our forecast of commercial small UAS in the previous Aerospace Forecast thus undershot (around -4.4%) for 2023 (or 842,460 actual aircraft vs 805,448 projected aircraft).

“The FAA forecasts that the commercial UAS fleet will likely (i.e., base-case scenario) exceed the million aircraft mark with around 1.12 million by 2028. This is 1.3 times larger than the current number of new commercial small UAS. Using low-case scenario or effective/active fleet, the FAA forecasts an expansion of the small UAS fleet by 12,800, 1.03 times larger than the currently calculated effective/active.

As the present base-case scenario (i.e., the cumulative total) increases, the FAA anticipates the growth rate of the sector will slow down over time, and the effective/active fleet will likely catch up with the growth trajectory of new registrations. Nevertheless, the sector will be much larger than what was understood only a few years earlier.”

For more information

https://www.faa.gov/dataresearch/aviation/aerospaceforecasts/faa-aerospace-forecast-fy-2024-2044