By Philip Butterworth-Hayes

On 19 September 2024, the Single European Sky ATM Research (SESAR) Joint Undertaking announced that 18 exploratory research projects had officially kicked off as part of a new round of EUR26 million funded research. Of these, two of these have a direct relevance to lower airspace – CORUS Five, involving the development of the extended U-space Concept of Operations, and U-AGREE, the U-space Air and Ground Risk modEls Enhancement programme. One, VISORS (the Validation Infrastructure SuppOrting Remote Simulations) has an indirect relevance.

In May 2024 Unifly announced it was participating in the sUAS Well Clear Requirements project, part of the Alliance for System Safety of UAS through Research Excellence (ASSURE), a research programme initiated by the US Federal Aviation Administration (FAA) in collaboration with partner universities. ASSURE comprises 29 research institutions and more than a hundred industry and government partners with a total funding of approximately USD90 million.

On the face of it, the world of government-funded UTM research is alive and well. But even a shallow dive beneath the surface tells a very different story. Many national UTM government research programmes, especially in Europe, have all but disappeared. The focus on small UAS (sUAS) UTM research has shifted hugely over the last few months to providing UTM services for eVTOL operations.

And while many in the industry would argue that this is exactly what should be happening at this stage of the industry’s incubation, with UTM service providers shortly to be certified for commercial operations, others are others worried by the remaining gaps in understanding – by governments and regulators – in how core UTM technologies will be implemented.

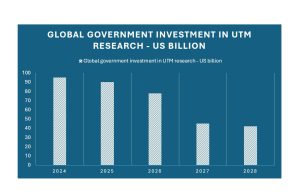

The table below, taken from Unmanned Airspace’s latest The market for UAV Traffic Management Services – 2024-2028, study forecasts the decline in government-funded UTM research over the next few years, based on estimates from research organisations and government public plans. For the drone UTM industry – and there are still large gaps around the world in agreeing on which elements of drone UTM should be adapted or replaced for eVTOL UTM – these figures are worrying, as the percentage of research funding for eVTOL operational research rises every year at the expense of drones.

The focus of global government-funded UTM research in the last 18 months has changed from validating core concepts to researching how key elements – detect and avoid, UTM/ATM integration, ensuring security – can be introduced into real-word operations. But there is still fundamental UTM research to be done; ASSURE’s future sUAS UTM research programmes comprise “Analyze Drone Traffic (A83_A11L.UAS.122)”; “Develop a Data Driven Framework to Inform Safety Risk Management Mitigation Credit Estimates (A82_A11L.UAS.112)” and “Develop small Unmanned Aircraft Detect and Avoid Human Factors Requirements (A81_A11L.UAS.114).”

One of the most significant conclusion of the November 2023 FAA’s UTM Field Test final report was that although UTM technology proved robust there were still important missing elements in terms of standards and implementation, some of which will be the responsibility of industry rather than government-back research – although how and when the regulator will sign off on these procedures has not been made clear.

“UFT developed and tested key ASTM standard elements for strategic deconfliction,” said the report. “Further progress is needed to address implementation gaps of the ASTM standard, such as availability arbitration and aggregated intent conformance monitoring…. Industry should evaluate important governance issues, such as service quality, and ensure agreement on the approach to meet the FAA requirements on safety, security, and privacy. This supports maturation of elements in UTM such as Cooperative Operating Practices (COPs) and authorization server implementation.”

And for countries outside the FAA/NASA and SESAR research umbrella – such as Korea, Japan and the UK – long term government-backed funding plans for drone UTM-based research is coming under increasing pressure from the eVTOL industry, who will need operational UTM systems in place to manage the first commercial eVTOL flights in 2026, or shortly after.

There could be several consequences to this.

The first is that though millions of dollars and Euros have been spent on making sure UTM technology is robust enough to meet the concept of operations targets, not enough funds are being put aside to finance the implementation of this technology in ways which make economic and operational sense to all stakeholders. This will delay operational implementation even further

The second is that independent UTM companies who have relied on government research to finance their business development plans will find the next few years tough going, given the current times-scale for UTM/U-space implementation. Income from operations will not be sufficient to make up for the loss in research funding.

The UTM research challenge of proving the robustness of the technology is proving less complex than finding ways to implement it.

(Image:Shutterstock)