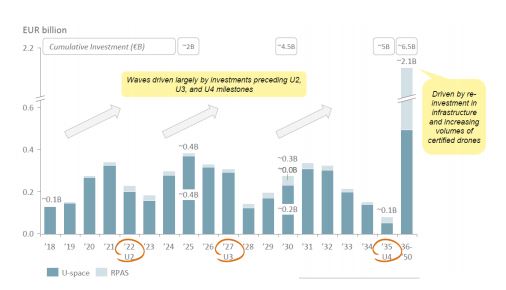

European U-space providers will need to find EUR 2 billion in investment between now and 2035, air navigation services providers (ANSPs) EUR 0.7 billion and drone operators a further EUR 0.7 billion to develop a European UAS traffic management system, according to the latest European ATM Masterplan for drone integration published by the Single European Sky ATM Research Joint Undertaking (SESAR JU) (http://www.sesarju.eu/sites/default/files/documents/reports/European%20ATM%20Master%20Plan%20Drone%20roadmap.pdf)

According to the “Roadmap for the safe integration of drones into all classes of airspace” around EUR 1.28 billion will be required for ATC interface and airport adaption systems, EUR 0.98 for drone traffic management systems and EUR 0.38 for protection of airports and sensitive areas.

| Stakeholders | Investment (billions) |

| U- Space service provider | Around EUR 2 |

| Drone operators | Around EUR 0.7 |

| ANSPs | Around EUR 0.7 |

| Telecom/satcom providers | Around EUR 0.6 |

| Airports | Around EUR 0.3 |

| Airspace users | Around EUR 0.1 |

| Others | Around EUR 0.2 |

| Total | Around EUR 4.5 |

“European demand within the drone marketplace is valued at in excess of EUR 10 billion annually, in nominal terms, leading to a cumulative benefit of over EUR 140 billion by 2035,” says the SESAR JU study. “Civil missions for government purposes and commercial businesses are expected to generate the majority of this value on the basis of multi-billion product and service industries. Defence and leisure industries will continue to contribute to this marketplace and remain a source of high value in the near-term, representing together nearly EUR 2 billion in annual product-related turnover for the industry over the long term. The minimum infrastructure investment required to ensure safety and unlock the value at stake for Europe is attainable through relatively low investments, leveraging existing infrastructure and scaling-up through investments in automated and smart systems. The assessment has identified key investments by stakeholders amounting to nearly EUR 4.5 billion by 2035.”

| Investment category and subcategory | Investment (2035) (EUR billions) |

| Infrastructure and services | ~3.4 |

| ATC interface and airport adaptions | ~1.28 |

| Drone traffic management | ~0.98 |

| Protection of airports and sensitive areas | ~0.38 |

| Telecom and satcom | ~0.68 |

| Geofencing database | ~0.18 |

| Enhanced data provision and info sharing | ~0.18 |

| Drone traffic management oversight | ~0.18 |

| E-registration and identification | ~0.18 |

| Systems hardware and software | ~0.78 |

| Drone systems | ~0.68 |

| On other aircraft | ~0.18 |

| Human resources | ~0.48 |

| Procedure development | ~0.38 |

| ATC personel traiming | ~0.18 |

| Total | ~4.58 |

| (to 2050) | ~6.58 |

”

U-space service providers and drone operators are expected to invest the most across stakeholder groups. For U-space service providers, this is driven by the investments required to support new investment services in the ecosystem, while large investments for drone operators are required to ensure the drones are appropriately equipped to enable the required services. The scale of operations and growth in drones are expected to grow substantially, making the associated investment meaningful (the specific category fleet size will evolve from under 10 000 drones in 2015 to nearly 400 000 drones in 2050). The Military is not listed per se since this stakeholder is not integrated into the various roles, i.e. airspace user, ANSP, airport operator and drone operator. Stakeholder inputs on required military investments (air and ground) were not fully available at the time of publication. A standalone assessment of available military data indicates that partial investment levels are in the order of EUR ~400 million.”