The first step is always the hardest. In the initial 2022 GUTMA Harmonized Skies webinar of 15th March – From standards to market: Can we get a competitive U-space services market? – U-space services providers (USSPs), regulators and commercial drone operators from Europe and beyond discussed how, where and when the first commercial U-space services to support automated beyond visual line of sight (BVLOS) drone operations will be implemented in Europe

There are, according to Koen de Vos, Secretary General of GUTMA, three distinct but interlinked markets under construction: the drone services, the drone operations and the U-space services markets. They are a pyramid. “Most of the value is created in the drone services market and the challenge for this sector is business development, integrating drones into industrial value chains.” How can we make U-space an efficient enabler to create down-stream value creation, is the key question, he said. To have a large base of this pyramid we need competition to drive innovation, to keep the costs down for drone operators and service providers.

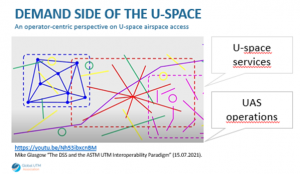

U-space areas will have to accommodate many different types of operations – from long range surveillance flights (purple), drone delivery operations from a central distribution centre (red), point to point operations (green), training flights (yellow) etc – image courtesy of Larissa Haas

According to Henrik Hololei, Director-General for Mobility and Transport, European Commission, “We have gone from concept to regulatory implementation in only five years.” There is an urgent need for a framework to support the free movement of U-space operators and service providers across the European Union, and this framework will go into operation early next year. But Member States are implementing U-space at different speeds. Munish Khurana, Business Development Senior Manager, Eurocontrol, said the very first step required by the U-space regulation (Regulation 2021/664) is to establish U-space airspace. But should this be driven by rural or urban market demand drivers? Or should the process be prioritised around the risks associated in each area, or even environmental concerns? And how should drone operators and USSPs engage with regulators to identify first use cases?

Drone delivery company Manna’s business plan is to start services in suburbs and roll-out operations in multiple European markets at once, from 2023 onwards, depending on population density, said the company’s CEO Bobby Healy. “But for this you need granularity of your U-space and each one will have different characteristics and different service providers. The first markets for us will be those which implement U-space services – today we have capacity for 200-400 flights a day, with a 6 minute drone flight. We need to be able to allocate 3D airspace over time for those flights. We want to work together with competitors that share the airspace with us. The number one stakeholder in this is the suburban communities we fly over and they should be able to use their own airspaces for their own needs.”

For Bobby Healy the key to successfully implementing new drone operations is to start engaging with local communities, working with schools, chambers of commerce and local government and then speak to regulators, demonstrating the company’s safety record. “I have yet to meet a market that hasn’t welcomed us,” he said. He predicted that in two years there will be five or six European markets that will have ubiquitous implementations of U-space, within three years this will have developed more widely as communities see the job creation benefits.

According to Amit Ganjoo of IT provider ANRA, the development of U-spaces should always be driven by the use-case. “Anything that has a human aspect we see as an early adopter,” he said. “We are seeing many initial use cases taking place in remote and hard-to-reach areas…..the trouble comes when that “bubble” intersects controlled airspace.” There are three circles to implementation – technology, standards and regulations – and the first use cases will be where there is an intersection between all three of them. He cited Switzerland’s FOCA as one way of ensuring regulators and operators were fully in sync. “FOCA pulled in a lot of industry players to identify where technical means of compliance lined up with the U-space regulations.”

According to Thorsten Indra of Hamburg’s HHL Sky, who is supporting the development of a drone eco-system in Hamburg port, the best way to start is with a vertically separated airspace and one or two initial operators. “Early on there may be only a small community that has a need to have U-space established. As they see the benefits then others will join. We need round tables with users to get their buy-in but also establish each other’s needs.”

Thomas Neubauer of TEOCO said to build the base of the pyramid will mean understanding how to automate processes – the first end-to-end application is where we need the U-space to be established and scale it from there. This U-space area would vary depending on the drone operation. The company was working with commercial customers on inspection services which involved a single drone flying 100 km on powerline, pipeline and rail inspections. At the same time, it was supporting a range of public safety and first responders in a less well-defined area. “Today we are working on identifying which airspace areas will enable the connectivity you need using existing infrastructure and what the ground risk looks like. In the SESA R GOF2 project, the company is supporting the testing of end-to-end use cases in seven countries.

Maria Algar Ruiz of EASA opened the debate on the best way of certifying USSPs.

Even with a single EU regulation you will still have different USSP agreements which will differ from country to country, said Benoit Curdy of FOCA. “As a USSP you will need to sign an agreement with the ANSP and another agreement to access CIS data; there might be additional local needs to take into account.” If you want to have the EU single market we talked about we need to have harmonisation down the line – including the small print of certification and safety audit arrangements. We need harmonisation of legal documents and templates.” FOCA is making the template it has developed available to others as part of the Linux inter-USS platform work it has undertaken.

FOCA, just a few weeks ago, issued a call for potential USSPs in Switzerland and the call has already generated more than 20 expressions of interest.

But, according to Ralph Schepp of Droniq: “The certification process for the German local competent authority (to certify USSPs) has not even started….if I want to be certified to operate in Switzerland I would need a subsidiary there. It’s a missing piece and it makes me nervous about the pace of change in Europe compared to other parts of the world.”

We need the Common Information Service established as a “single source of truth”, he said, and thought there were still some missing links in the eco-system framework – such as the use of mobile networks for automated communications.

Matthew Satterly of drone operator and USSP WING outlined his company’s priorities. These included a reliable and repeatable way for drones to access airspace – which is currently a highly manual process. U-space will help remove some of the complexities. Flexibility is important. UAS operations will be very diverse and to cope, U-space will have to be more customized than traditional ATM. Scalability is also very important. U-space services will have to evolve quickly, with automated testing and routine updates, as an operator will always want something state-of-the-art. “And we need broad situational awareness to make sure we are maintaining safe separation from other UAS, traditional aircraft operators and recreational users.”

Christopher Kucera, One Sky, suggested the way the US Federal Aviation Administration (FAA) organised the approval process for LAANC could set the scene for USSP approval process in Europe. “The USS interoperability standard from ASTM is going to be critical for strategic conflict detection services that we think will help with BVLOS operations,” he said.

There is another market which we will also need to consider – the access to the airspace itself, according to Sven Seuken, University of Zurich, which is important when it comes to airspace authorisation and conflict resolution. But with all the safeguards in place what is there left for USSPs to compete over? And what will prevent the largest USSP simply driving out others in the market by offering cheaper prices?

According to Thomas Neubauer we are already seeing U-space service providers generating additional value that is maybe specific for individual industry segments. USSPs will specialise and tailor their offering that will guarantee the most reliable end-to-end service packages.

We are hoping for a multitude of USSPs, said Joachim Lüecking, DG MOVE, European Commission. UAS operators can also supply U-space services themselves but then they will have to abide by the U-space regulation – and general EU competition rules will apply to this market. “We have created a market where quality of service is guaranteed at a high standard in view of the safety implications but where the USSPs are free to set their prices.”

If several USSPs are operating in a market, then prices should be driven down to a level which is acceptable to the customers. If there is only one supplier – identified as a dominant provider – then competition rules then apply which prohibit the abuse of a dominant position.

Price and quality of service will be competitive parameters, not safety, he said. Pricing models could include price-per-flight packaging with other services. But there is currently not a lot of clarity in the market as to how the pricing will be set.

We want to avoid market concentration or abuse of market power, said Larissa Haas of FOCA. There will need to be extra services available to mitigate risk.

“With systems becoming increasingly autonomous the need for data exchange becomes more critical and data services will generate a competitive market,” said Brent Klavon of ANRA. We will want to compete to provide the four main U-space services but also provide value added services – such as data analytics and specific use-case services.

Jorge Chornique of Airbus focused on how drone operators saw the market for U-space services.

It is up to the USSPs to decide how they are going to compete, said Alan Hicks of Manna. “The biggest challenge is how do they do that across all the common jurisdictions because we fully intend to be operating in multiple countries and the last thing we want as a user of those services is re-integrate and re-integrate.”

Rinaldo Negron of WING said there is probably not one service provider who will support all drones and the way they fly – it will be necessary to have this broad supply base to service the diverse range of drone services.

| GUTMA develops position paper on guiding principles for European drone policy

At the conclusion of the conference the GUTMA Secretary General announced that GUTMA had adopted a position paper as a concrete contribution to the European Drone consultation process. This paper establishes a series of guiding principles for the European drone policy and gives a long list of concrete recommendations. The headlines of the position paper are: * Competition – there needs to be fair competition in the three markets – U-space services market, the drone operations market and the drone services market. * Business development: eventually, the question is how industries will make best use of processed data that are gathered with drones that are operated as flying IoT platforms and how these services then can be monetized? * Societal impact: what instruments are available to local authorities to manage externalities of drone operations? * Governance: how should traditional aviation governance structures be extended to better reflect the new realities/technologies/markets/business models? * Let it grow! What measures could best be taken to let the U-space airspace grow to integrate ever more traffic and integrate U-space and drones into other value chains, like energy supply or the digital infrastructure? The GUTMA position paper is available at

|

(Image:Shutterstock)