An Federal Aviation Administration (FAA) report on national spaceports policy delivered to Congress says the US is the international leader in spaceport development and operations. “Countries are continually investing in upgrades to their spaceports to support existing and new launch vehicles for both government and commercial activity. Currently only Russia, a combined Europe, Japan, China, India, Israel, Iran, South Korea, North Korea, and New Zealand can independently launch a satellite into orbit. Many of the spaceports in these countries are operated by their respective governments, similar to U.S. Federal ranges. About half of these countries are active in the commercial launch services market.

“Countries like Russia, China, and India are rapidly developing new sites to accommodate the expanding activity. A number of other countries are also looking to enter the commercial spaceport market including but not limited to Brazil, the UK, Japan, Canada, Sweden, and Australia. With the increase globally in the satellite market, there is a corresponding increase in the development of new, global launch vehicles and an opportunity for countries to attract new commercial launch business by upgrading or developing entirely new spaceports. Additionally, the development of horizontal launch systems has encouraged many countries to look at utilizing existing aviation infrastructure for commercial space launch opportunities,” says the report.

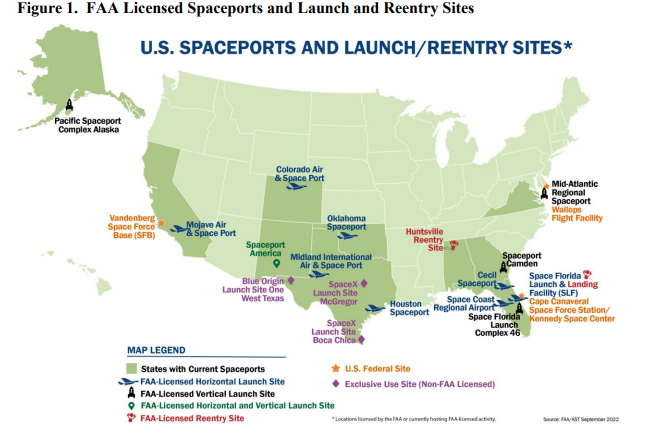

The FAA report on national spaceports to Congress provides an overview of the types of spaceports that exist, the launch and reentry statistics for commercial space transportation operations, and an overview of international efforts and Federal Government investments at spaceports.

According Space News, the FAA forecasts that commercial launches it licenses could more than double in the next several years, putting an additional strain on the handful of spaceports that host them. The report noted that there were 74 FAA-licensed commercial space operations in fiscal year 2022, which includes both launches and reentries. That total is dominated by launches, with 69 in 2022 versus five reentries.

The forecast included in the report projected a sharp increase in licensed operations, growing from a range of 53 to 92 in fiscal year 2023 to a range of 59 to 186 in 2026, the final year of the forecast. The report does not break out launches and reentries, but historically launches have dominated the total, with the only reentries by a handful of commercial cargo and crew vehicles, says Space News.

The major findings of theFAA report are:

− Most (92%) of commercial space transportation launches in the past three fiscal years have been vertical launches.

− Nine (64%) of the 14 FAA-licensed spaceports are licensed for horizontal launches and five (36%) are licensed for vertical launch.

− Of the five sites that are licensed for vertical launch only three are located off federal ranges, and only two of those three (14%) can host a launch at this time.

− Almost two-thirds (62%) of all U.S.-based launches occurred at federal ranges on average in the past three fiscal years. The rest occurred at either FAA-licensed spaceports (21%), or exclusive use launch sites (16%).

− The high percentage of commercial launches occurring from federal ranges can be attributed to two things: (1) the significantly limited number of off-federal range vertical launch sites and (2) existing government infrastructure and services available for commercial use on federal range launch sites at “direct cost” per Title 51 section 50913 (“direct costs” are significantly cheaper than the rates commercial sites are typically able to offer) − International FAA-licensed operations have held steady at about six to seven operations per year for the past three fiscal years.

− Internationally, governments continually upgrade existing launch sites to accommodate current and new launch vehicles for government missions and adapt to accommodate commercial missions.

− Several countries are developing entirely new spaceports or upgrading existing suborbital sites to orbital capabilities through substantial governmental investment while simultaneously developing new legislation and regulations to attract commercial domestic, U.S., and international small-launch providers.

For more information visit: