AeroVironment, Inc. (AV) and BlueHalo LLC have announced the execution of a definitive agreement under which AV will acquire BlueHalo in an all-stock transaction with an enterprise value of approximately USD4.1 billion.

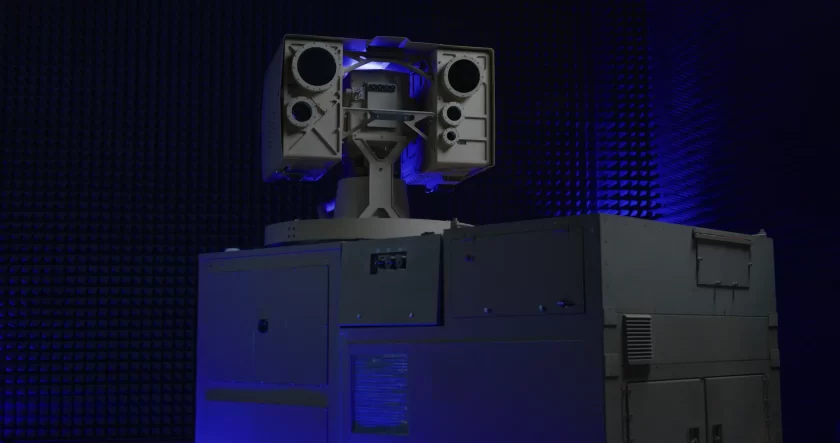

The combined company will bring together complementary capabilities to offer an expanded portfolio. BlueHalo, an Arlington Capital Partners portfolio company, was founded as a purpose-built platform providing capabilities in several key mission areas including counter-uncrewed aircraft systems (C-UAS), space technologies, directed energy, electronic warfare, cyber defence and artificial intelligence.

BlueHalo delivered its 1000th C-UAS system last year with its Titan and Titan-SV systems. The company estimates that it will achieve more than USD900 million in revenues for 2024, in addition to a funded backlog of nearly USD600 million and a pipeline of multiple billion-dollar opportunities and programs of record. BlueHalo generated approximately USD886 million of revenue in 2023, compared to USD759 million and USD660 million in 2022 and 2021, respectively.

AV expects BlueHalo’s portfolio of 10 flagship solution families and more than 100 patents will integrate with AV’s complementary existing expertise in the design, development, manufacturing, training and servicing of uncrewed systems, loitering munitions and advanced technologies. AV and BlueHalo believe that these synergies will primarily be identified as administrative and operational cost savings and sharing best practices from each company.

The combined entity plans to develop and deliver next-generation technologies that will have “significant military value”. On a pro forma basis, the combined company is expected to deliver more than USD1.7 billion in revenue.

The transaction, which has been unanimously approved by both companies’ board of directors or managers, is expected to close in the first half of calendar 2025, subject to regulatory and AV shareholder approvals, as well as other customary closing conditions.

Following the completion of the transaction, AV Chairman, President and CEO Wahid Nawabi will be Chairman, President and CEO of the combined company. Jonathan Moneymaker, CEO of BlueHalo, will serve as a strategic advisor to Mr. Nawabi and the combined company Management Team.

Upon closing, the AV Board of Directors will be expanded to comprise 10 members. Arlington Capital Partners will have the right to appoint two directors to the Board, subject to minimum ownership thresholds.

The combined company will be headquartered in Arlington, Virginia, at AV’s corporate headquarters.

For more information

Image: BlueHalo