The September 2024 “forecasts of forecasts” of the commercial drone sector by Unmanned Airspace shows another fall in commercial drone market growth estimates, with compound annual growth rates (CAGR) for the global drone sector over the next few years now down to 14.4%, down from 17.9% recorded in September 2023 and 24% in the January 2023 forecast of forecasts.

While this is still a very robust figure for annual growth rates, the wide variations in market values (from USD4.2 billion to over USD220 billion) and CAGR forecasts for the next few years (a low of 2.24% and a high of 35%) show that this remains a highly complex market with major disagreements between forecasters on the scale and growth rates of the industry.

The very high and very low outliers also provides a measure of distortion to the overall figures. But both the low and high outliers (and all the numbers in between) have reduced considerably over the last 12 months and there is a clear trend of reduction in optimism among most forecasters.

High-level market reports for BVLOS drone operations show a compound annual growth rate of 26.9% over the next five years. The starting base, however, is extremely small. Drone Industry Insights reports the current (non-China) BVLOS/VLOS flight hours to be around 1.9 million in 2023, of which BVLOS flights accounted for under 100,000 hours.

Drone industry forecasts in 2023/2024

| Forecaster | Market value | Years | Market | Growth rate |

| FAA | 2023-2028 | Small sUAS fleet | CAGR 2.4% | |

| Statistica | USD4.3 billion in 2024 | 2024-2029 | Global drone industry | CAGR 2.24% |

| Drone Industry Insights | USD54.6 billion | 2024 | Global recreational and commercial UAS | CAGR 7.1%

(from 2023) |

| Skyquest | USD22.4 in 2022 rising to USD166.7 billion in 2031 | 2024-2031 | Global commercial UAS market | CAGR 35% |

| Spherical Insights | USD260 billion by 2030 | 2021-2030 | Global drone market | CAGR 27% |

| Market and Markets | USD30.2 billion in 2024 rising to USD48.5 billion | 2024-2029 | Global drone market | CAGR 9.9% |

| Mordor Intelligence | USD35.28 billion in 2024 and USD67.64 billion by 2029, | 2024-2029 | Global drone market | CAGR 13.9% |

| Research and Markets | Consumer | 2022-2029 | Consumer drone market | CAGR 17.26% |

Statistica reports that in 2024, the global drone market will be worth USD4.3 billion. “It is projected to grow annually by 2.24% (CAGR 2024-2029),” says the market analyst. “When comparing global figures, in China generates the highest revenue with USD1,526 million in 2024. This translates to per person revenues of USD0.55 in 2024. “By 2029, the volume in the drone market is expected to reach 9.5 million pieces. There will be a volume growth of 3.2% in 2025.”

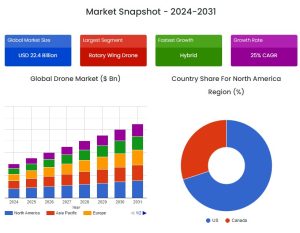

Skyquest reports that the global drone market was valued at USD22.4 billion in 2022 and is poised to grow from USD28 billion in 2023 to USD166.7 billion by 2031, growing at CAGR of 25% over the forecast period.

Source: Skyquest

“The security segment holds the largest market share in terms of applications,” says the company. “Drones are highly used for surveillance border control and public safety which provides real time data and enhanced situational awareness….on the other hand the fastest-growing application segment is environmental monitoring. The major constraint is the regulatory environment. The USA is the largest geographic market but the Far East is the fastest growing.

According to Drone Industry Insights latest global market forecast, the global commercial and recreational drone market size is forecast to reach USD54.6 billion in 2024, up from USD33 billion in 2023, at a CAGR of 7.1%.

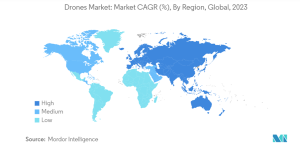

According to Mordor Intelligence the drone market size is estimated at USD35.28 billion in 2024 and is expected to reach USD67.64 billion by 2029, growing at a CAGR of 13.90% during the forecast period (2024-2029).

“The recent changes in drone regulations in several countries across the region are expected to support the market growth in Asia-Pacific. China has become the global hub for drone manufacturing over the last six years. More than 70% of the global civilian drone market is supported by China. The Chinese government is providing various subsidy schemes and other favorable domestic policies for drone purchases to promote the adoption of drones in various industrial sectors.

The global drone market is expected to reach USD 260 billion by 2030, at a CAGR of 27% during the forecast period 2022 to 2030, according to a March 2024 report published by Spherical Insights. The report finds the drone market was worth USD28.5 billion in 2021, rising to USD260 billion in 2030 at 27% CAGR.

A June 2024 report from Markets and Markets says the UAS market is estimated to be USD30.2 billion in 2024 and is projected to reach USD48.5 billion by 2029, at a CAGR of 9.9% from 2024 to 2029.

The global forecast says primary impetus for the expansion of the market stems from “robust business demand and rapid technological innovation”. Key factors include the adaptation of UAS for enterprise solutions, such as inventory management and precision agriculture, coupled with significant advancements in robotics and telemetry.

The report notes that the beyond visual line of sight (BVLOS) segment is projected to exhibit the highest CAGR. “This growth is primarily attributed to advancements in UAS capabilities that enable extended operational range. These improvements facilitate a broader range of applications, including long-distance monitoring and automated deliveries, thereby driving market expansion. This segment’s growth underscores the increasing demand for UAVs capable of executing missions over distances beyond the operator’s direct visual range, highlighting a significant shift towards more versatile and autonomous UAV operations.”

The consumer drones market is expected to grow at a compound annual growth rate (CAGR) of 17.26% from USD5.713 billion in 2022 to USD17.412 billion in 2029, according to a June 2024 report from Research and Markets.

The report notes that the growing popularity of aerial capturing and integration of artificial intelligence (AI) is likely to propel market growth. “Manufacturers have focused on the automation of consumer drones using artificial intelligence, which permits the programming of navigation commands within the drone itself,” the report states. “The adoption of artificial AI allows drone users to capture and use optical and environmental data from sensors connected to the drone. Through this technology, drones can recognise objects in the air and analyse and capture data on the ground.”

The report spotlights China as a key growth market. “According to the Civil Aviation Administration of China, 1.27 million licensed UAVs were registered at the end of 2023, which was a 32.2 percent increase from 2022,” the report continues. Civilian drone use alone logged 23.11 million flying hours in China in 2023, representing an 11.8 percent increase over the preceding year.

Meanwhile, last year, the US Federal Aviation Administration (FAA) forecast that the recreational small UAS sector would have around 1.75 million drones in 2023 in base case (i.e., new registrations), a growth rate exceeding 3.7% from the year before (2022). Actual data for 2023 came in higher by 26,613 units with around 1.78 million units accounted for by the end of 2023. Thus, our forecast of recreational small UAS last year undershot by around -1.50% for 2023

The FAA forecasts that the recreational small UAS fleet will likely (i.e., base-case scenario) maintain its peak with average or trend growth over the next five years, from the present 1.78 million units now to approximately 1.88 million units by 2028 thus attaining a cumulative annual growth rate of 1.2% during 2023-2028. In the previous Aerospace Forecast, the cumulative annual growth rate for small recreational UAS was reported to be 1.6% for 2022-2027.

The FAA also forecast the commercial UAS sector, which includes all UAS with weights greater than 0.55lbs and less than 55lbs operated for non-recreational purposes, would include over 805,000 small UAS in 2023 for the base case, a growth rate exceeding 11% over the previous year (2022). “Actual data came in over 842,000 aircraft by the end of 2023. Our forecast of commercial small UAS in the previous Aerospace Forecast thus undershot (around -4.4%) for 2023 (or 842,460 actual aircraft vs 805,448 projected aircraft). In the low-case scenario, the FAA forecasted 349,000 units to be effective/active for the year 2023 in the previous Aerospace Forecast; but in reality, the number was around 361,000 thus undershooting the lower-case scenario by -3.3%.”

The FAA forecasts that the commercial UAS fleet will likely (i.e., base-case scenario) exceed the million aircraft mark with around 1.12 million by 2028. This is 1.3 times larger than the current number of new commercial small UAS.

More forecast data and analysis on drone market growth and the implications of this on the UTM sector will be available in next edition of Unmanned Airspace’s report “The Market for UAV traffic Management services 2024-2028” – to be published next week. Please contact the editor Philip Butterworth-Hayes at Philip@unmannedairspace.info for more information.

(Image: Shutterstock – meal delivery by drone using the Meituan app. The future of order delivery in Shenzhen City)